Some of the Projects, Publications, and Presentations were given by Dr. Yen-Ling Chang and Dr. Daniel Talley are listed below.

Publications

Chang, Yen-Ling and Daniel A. Talley, Bank Risk in a Decade of Low Interest rates, Journal of Economics and Finance, 41(3), 505-528, DOI: 10.1007/s12197-016-9367-5.

Presentations

- Chang, Yen-Ling and Daniel A. Talley, November 2022, Investigation of the Response of the US Financial Institutions to COVID-19 Pandemic, Southern Economics Conference.

- Chang, Yen-Ling and Daniel A. Talley, November 2022, Investigate of the Response of South Dakoda’s Financial Institutions to COVID-19 Pandemic, Nebraska Economics and Business Association.

- Change, Yen-ling and Daniel A. Talley, February 2017, Risk and Asset Portfolio Management: An Investigation of the impact of Financial Reform on Financial Holding Companies, Academy of Economics and Finance.

Project

Investigation of the Response of South Dakota’s Financial Institutions to

COVID-19 Pandemic

Abstract

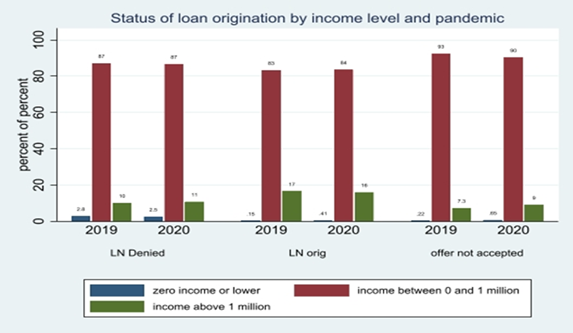

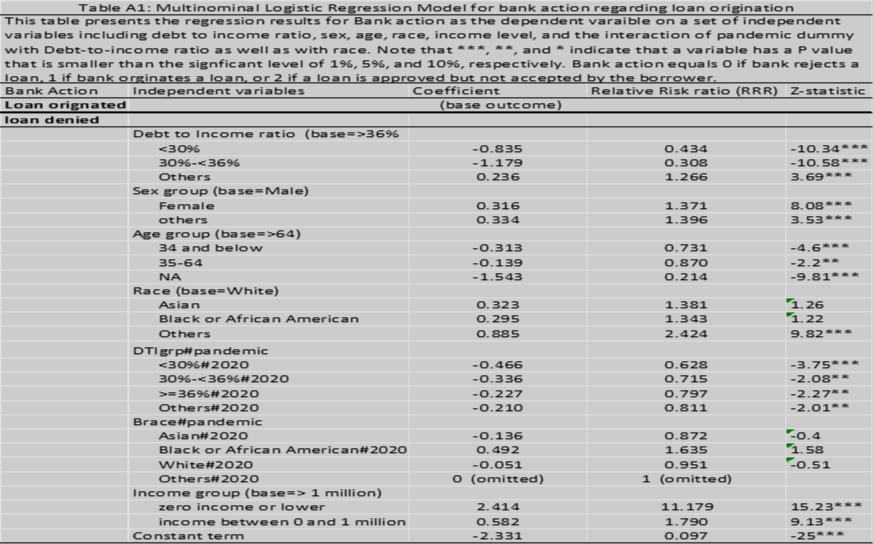

We compare South Dakota bank loan origination activities in 2020 with prior year (2019) to determine the effectiveness of the banking system in South Dakota in supporting regional business activities. We start with a focus on mortgage lending. The multinominal logistic model shows the number of mortgage loan originations were increased in 2020, suggesting that the banking institutions did not shut their door to make mortgage loans to individuals despite the pandemic that caused a brief economic recession. Our results also suggest that financial institutions in SD, when making loan origination decision, continued to focus on relevant factors of applicant’s likely ability to repay the loans without considering certain demographic characteristics like race. However, there is statistical evidence of a reduction in the rate of approval of mortgage loans by female applicants in South Dakota.

Hypotheses

We examined the following research questions:

- Compare the year of 2019 and pandemic year to examine how SD banks loan behaviors changed.

- Compare the year of 2019 and pandemic year to examine how the demographics of the business applicants and characteristics of loans changed (for example, sex, age, race, income, loan types, and loan purposes, etc.)

- Compare the year of 2019 and pandemic year to examine the loan denial rate and the reason/basis for denial.

Literature Review

Social, racial justice as well as income inequality have probably never been so

widely and openly discussed in all levels of our society in the recent human history. In this research we focus our research on an area that is economically relevant to the subject matter. That is the bank loan origination decision regarding a borrower’s race identity as well as other characteristics, especially during the COVID pandemic era.

Durbin, et al (Durbin, Li, Low, & Ricks, 2021) examined the impact of COVID-19 on the characteristics of mortgage borrowers, a striking result stood out as Black or Hispanic with a higher loan-to-value ratios are more likely to participate in forbearance program and are more likely to default on payments during the COVID-19 era. Gerardi, Lambie-Hanson, and Willen (Gerardi, Lambie-Hanson, & Willen, 2021) conducted similarly studies the mortgage outcomes/performance during the pandemic with respective to different racial and ethnic groups. Their findings suggest that Black and Hispanic borrowers were more vulnerable to risk factors such as high loan-to-value ratio and lower credit scores, which reduced their chances to be approved with refinancing.

Like Durbin et al (Durbin, Li, Low, & Ricks, 2021), they also show that Black borrowers were more likely to miss payments and therefore less likely to pay off a past-due loan. This situation was even exacerbated during the pandemic period. Agarwal et al (Agarwal, Chomsisengphet, Kiefer, Kiefer, & Medina, 2021) shows that refinancing inequality widened during the COVID-19 pandemic when compared to pre-pandemic years. They documented a ten-times greater refinancing savings for high-income borrowers when compared to low-income borrowers during the pandemic period.

Data and Methodology

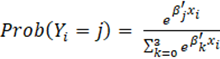

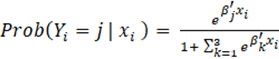

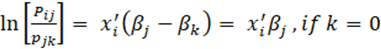

where j = 0 (unoriginated), 1 (originated),2 (approved but not accepted). Yi is bank’s decision on ith loan application.is a vector of variables, xi are vector of coefficient associated with β|j. The model is a multinomial logit model first developed by Nerlove and Press (1973) which allows a banker to estimate the probability of the J+1 choice with a set of characteristics xi. One can then modify the model into the following one to produce a log-odd ratio for j-choice to be chosen over k-choice.

for j= 1, 2, and

This model implies that we can compute J log-odd ratios.

Results and Discussions

Two main highlights:

A. SD Banks continued to lend regardless of pandemic.

B. As for bank lending decisions:

1. Income level matters

2. Age matters

3. Sex matters

4. Debt to income ratio matters.

5. Race does not matter.

Conclusions

Examining the pre- and during-pandemic loan origination data, our research provides evidence that financial institutions in South Dakota increased their lending activities given the strong local housing market as well as record low mortgage rates. More specifically, our findings show that gender, individual income level, age, and debt to income ratio are some of the significant variables that emerged as influential factors on financial institutions’ loan origination decisions. On the other hand, applicant’s race was not a significant factor.

This research could be extended to examine the impact of the pandemic on the national financial system to reach more general conclusions as to how financial institutions responded by providing adequate financial resources to those in financial distress due to an unprecedented health crisis.